Development of energy sector in Latvia, Lithuania and Estonia

May 11 in the Diplomatic Economic Club held a meeting with Juris Savickis, the President of ITERA Latvia, a member of the board of Latvijas gaze.

Juris Savicikis presented the current status and trends of development of power gas, answered questions from the participants.

Presentation of * pdf, Juris Savicikis at the Diplomatic Club May 11, 2017

Vice President of the Diplomatic Club Alexandra Csizmadia thanked J. Savickis for meaningful conversation and handed a commemorative souvenir from the Club.

The Summit was attended by Club members and invited guests:

L. Pankova, J.Cvek-Karpovich, Zh. Myrzakassimova, S. Shushunova, E. Lopatko, V. Osipov, A. Csizmadia, J.Reil, M. Shalaeva, V. Roldugin, K. Power, O. Pavuk, A. Butenko, I. Sheremet, J-F. Shklyar, P. Jiménez, A. Artykov, I.Freiberga, M. Rooze, K. Kokina, N. Alekseeva, V. Danilokh, V. Volkodav, J. Abdurasulov, D. Melnik etc.

Olga Pavuk, Chief-Editor of the journal Baltic-course.com After the meeting in the Diplomatic Club, noted in a publication:

Olga Pavuk, Chief-Editor of the journal Baltic-course.com After the meeting in the Diplomatic Club, noted in a publication:

" At the same time with energy market globalization manifests its regionalization. Amid the crisis, gas consumption in Europe is developing energy from renewable sources. In the United States is actively maintained by the development of shale gas. The extraction of heavy oil in Venezuela. Brazil beats records of offshore oil extraction. Canada was the first country to actively learning production of oil from bituminous sand. Qatar is building terminals or involved in their construction for acceptance of its liquefied natural gas around the world. Nearly half of the oil reserves are concentrated in the region of the Middle East. Along with the growth of the economy in addition to local sources of energy in China is a growing demand for energy exports.

Gas production grows

From the point of view of energy security, natural gas is the most reliable source of energy in peak mode compared to any other sources, including nuclear, solar, wind and hydropower.

World natural gas production growth to 2015 year accelerated to 2.2%, which is slightly below the average for 10 years at 2.4%. In North America recorded the largest increase (+ 3.9%) due to the continued significant growth in production volumes in the United States, while the production in Europe and Eurasia had decreased by 0.7%, while in the Netherlands and Russia saw a significant decrease in

Growth in consumption (+ 1.7%) also sped up with the very weak year 2014, but remained below average (2.3%) for 10 years. In the Middle East recorded the highest growth rates in the regions (+ 6.2%) and consumption in Europe and Eurasia had decreased by 0.3%, with lower growth in Russia slowed.

Demand for natural gas in the Baltic States falls

|

|---|

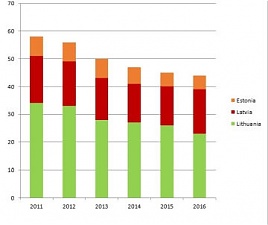

| Chart of consumption of natural gas in the Baltic countries, TWh |

Experts say the gradual reduction of the gas market in the Baltic States with 3.78 million. Cubic meters in 2016 to 3.50 million. cubic meters to the year 2023. Demand for natural gas in all three Baltic States over the past 6 years has dropped significantly. (graph 1)

In Lithuania the share of natural gas and the energy consumed is 29%, 24% in Latvia, Estonia 7%.

In the year 2016 Lithuanian gas market was closed because still acted subsidies for major customers, who are paid from funds received from Gazprom in the past as compensation for a very high price for gas and, therefore, is now in the Lithuanian market of gas could be sold below the current procurement prices are expected to further decline to a small gas market in Estonia.

Peak demand for natural gas in Latvia fell on the year 2010, more than 1800 million. cube. m. to 2015 year demand fell by 25%. But in 2016 year has seen an increase of up to 1400 m. cubic meters (Central Statistics Bureau of LATVIA). It is projected that natural gas consumption in Latvia is stabilized to 2020 year 10000 million level. cubic meters per year.

It should also be noted that according to analysts Ramboll Group & , Latvia ranked fifth in Europe in terms of security of gas supply (ahead of only Russia, Norway, Slovakia and Italy

Latvia’s natural gas demand is highly dependent on heat and electricity production, and hence from the weather. At the 2013-2014 y. in the structure of gas consumption 57% took the heat, 19% industry, 15% of municipal and commercial companies, 9% of private consumers. 60% of total sales Latvijas Gāze implemented enterprises for the production of electricity and heat in Latvia. (Source: ENTSOG).

Sector Latvijas Gaze

Obligations under the division of the Latvian gas company provided for in EU Gas Directive 2009/73 and supplemented by amendments to the Latvian Law on energy.

According to the amendments to the law «on energy», adopted by the 11.02.2016. and which entered into force on 08.03.2016, Latvia had chosen total separation of company property.

Section should occur in three phases:

April 1, 2017. Free choice of supplier. The selection of joint TSO and SSO as a subsidiary of the company.

2. December 2017. the easing of ownership.

3. January 2018 g. Separation of the DSO from a trading company.

After the partition to change the functions of both companies:

Latvijas Gaze: trading and distribution.

Conexus: transfer and storage.

The main requirements for both companies after the partition:

* Individual Council and Board.

* The absence of support functions.

* Separate offices

* Separate information systems..

* Companies cannot be part of a vertically integrated company..

opening of the Latvian market natural gas leads to several structural and conceptual changes.

| Indoor market | Outdoor market |

| Serves clients fully integrated single supplier | Customers can freely choose between multiple providers and/traders |

|

| Transmission, storage, and distribution are separated from the gas trade activity |

| Adjustable rates | Price can be negotiated between the client and the supplier/merchant |

| Limited product differentiation | Supplier/trader is not responsible for the security of supply |

| A single supplier by law, responsible for security of supply | Supplier/trader is not responsible for the security of supply |

| The decision by the provider is not limited only to commercial considerations | Decisions by traders is based solely on the commercial and competitive positioning |

Additional modifications with direct impact on expected customers:

1. In the case of the conservation importance of storage model listings for Latvia, open market will gradually shift toward greater emphasis on a gas year (April to March)

.2. In a context of declining or stagnant market with intensified competition «take or pay» will likely play a more significant role.

3. In the absence of a fully functioning and liquid trade center availability, additional unplanned demand will be limited and will be on the costs.

4. traditional petroleum-based pricing model with delay will gradually be supplemented by elements/arrangements based pricing hubs.

5. Customers will have more choices, but also more responsibility for their own commercial solutions.

Incukalns is the main asset of Latvia

|

|---|

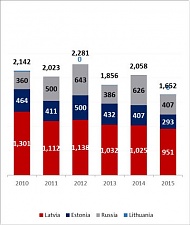

| Chart 2. Inchukalns gasholder gas (MCM) |

Regulation of underground gas storage facilities to supply in the EU is different in other countries. Thus, the obligation to store gas market participants stipulated by law in France, Spain, Portugal, Belgium, Denmark, the Czech Republic, Slovakia, Poland,

.Strategic gas storage provides legislation in

Italy and Hungary.there is no Regulation in the UK, Germany, Austria and the Netherlands.

Unresolved questions remain concerning the «Inčukalns» gas storage. To ensure Latvia during winter on the pipeline impossible. Physical supply in the Baltic region remains limited. Inchukalnskoe store remains a major asset for the current supply of natural gas to Latvia.

Historically Inchukalns gasholder provide gas in the winter in Latvia, Estonia, Russia and Lithuania. The 2016 year was the first year when the Gazprom decided not to pump gas in store for Russia, while Estonia has chosen to receive gas via pipeline. The total amount entered in the store in the 2016 year amounted to 1532 Mw, and about 200 MSK-Russian gas the previous season.

The basic model for Latvia today: putting gas in storage in summer and in winter and the management of large changes in demand through the existing flexibilities in a long-term agreement to supply

.Development of future tariff model and absolute level of tariffs for gas storage will solve the question of the attractiveness of the store for traders on the open market. The increase of tariffs for gas storage for Latvian clients inevitably. Reserves of natural gas in storage Inčukalns village declining (Chart 2).

Transit of gas

.In 2015 year gas transit through Latvia totaled 485 million cubic meters. In Estonia was delivered 97 million. cubic meters of gas from Lithuania through Latvia, representing 20% of total consumption. The same trend continued in the year 2016. technically these supplies would not have been possible without the «Inčukalns» storage since the actual gas from Lithuania bundled customers in Latvia, but in Estonia, deliveries went from a warehouse, and thus Latvijas Gāze subsidized gas customers in Estonia

Issues, barriers and opportunities common gas market in the Baltic States

Gas market in Europe is undergoing reform. Major investment projects cover construction of several LNG terminals, six natural gas storage facilities and five joints

Experts predicts the gradual reduction of the gas market in the Baltic States with 3.78 million. M3 in 2016 to 3.50 million. cubic meters to the 2023 year.

Taking into account the reduction of financial flows already in the year 2017 as consequence of the Brexit, the restructuring of the gas transport system to connect to the European ring can become a heavy burden for the participants of the market of the Baltic States. Accession to the European pipeline system and reconstruction of pipelines inside the Baltic countries will be worth more than half a billion dollars.

* GIPL (Lithuania 27.45 million. euro, Latvia 14.7 million. euro, Estonia 1.5 million. euro).

* Balticconnector ~ 250 million. euro

.* Inchukalns underground gas storage ~ 87 million. euro

.* Gas connection of LV-LT ~ 95 million. euro

.* Commissioning bows LV-EE ~ 37 million. euro p>

Many years discussed a project for the construction of a regional LNG terminal in the Baltic Sea region with the assistance of the European funding.

Built at the same time without European investment terminal in Klaipeda, can not become regional. According to J Savickis, the best place for the regional LNG terminal could be Latvia. But most likely will win a joint project of Estonia-Finland

.In Latvia market development will stall the unresolved Inčukalns UGS and the necessity for large investments in infrastructure. Development of future tariff model and absolute tariff levels on storage will solve the issue of attractiveness for traders on the open market.

Thus, even after the opening of the gas market in Latvia, April 3, 2017 year functioning of a common gas market in the Baltics would be problematic. The solution to the problem would be to establish a joint Baltic market with clear and transparent rules that would increase the liquidity of the market. "

Appeal to world leaders and humanity

Appeal to world leaders and humanity